UCB Upay Mobile Banking Registration Bonus, All Offers & Guide

Install Upay App from Google Play Store or Install after Downloading the APK File of the App. UCB coming to service with mobile banking ‘UPAY’. Today we will discuss the Upay. We will discuss what this method really is, the basic idea about the method, and what the benefits might be. UCB Limited is currently one of the best banking companies in the private sector in the country. UCB Limited is going to provide mobile financial services by forming a separate subsidiary.

The government has approved UCB Fintech Company Limited, a subsidiary of Sampriti Bangladesh Bank UCB, to provide mobile banking services. UCBL’s new banking service will be launched under the name ‘Upaya’. All UCBL customers, now known as ‘UCash’, will be automatically connected to the mobile banking ‘Upay’ platform. UCBL has launched ‘UCash’ since 2013. This Mobile App can be used as Digital Wallet and also as Mobile Banking.

‘Ucash’ is providing mobile banking services to more than one million customers. So UCB has decided to form a subsidiary to provide more comprehensive and innovative mobile banking services. On December 26, in response to an application from Bangladesh Bank, permission was granted to provide mobile banking services in favor of UCB Fintech Company Limited.

Quick Links:

About Upay Mobile Banking

Saidul Haque Khandaker, Managing Director, UCB Fintech, reiterated that the ‘Upay’ service will be launched by March after completing all the commercial and technical processes. UCB Fintech Company Limited is making extensive preparations to provide customers with an easy, secure and affordable financial service.

The good news for the customers is that from the day the ‘Upay’ service is launched, the customers of ‘Ucash’ will become the customers of the new mobile banking service. ‘Upay’ is a platform blockchain-based. Here the highest security of the customers has been given priority.

Customers will be able to enjoy the service using Upay’ Apps and USSD. The ‘Upay’ is a payment service, not a mobile banking system. Upay has no agent. An account can be opened online with a NID card. However, the NID card must be Bangladeshi. Only one account is opened with a single NID card. With ‘Upay’, if you want, if you have an account with United Commercial Bank, you can add a link with it.

The account can be used, but the account can not be loaded on the mobile. So you have to transact money from another bank first. No charge is taken during the transaction. With mobile banking, money can be withdrawn from the bank’s ATM booth.

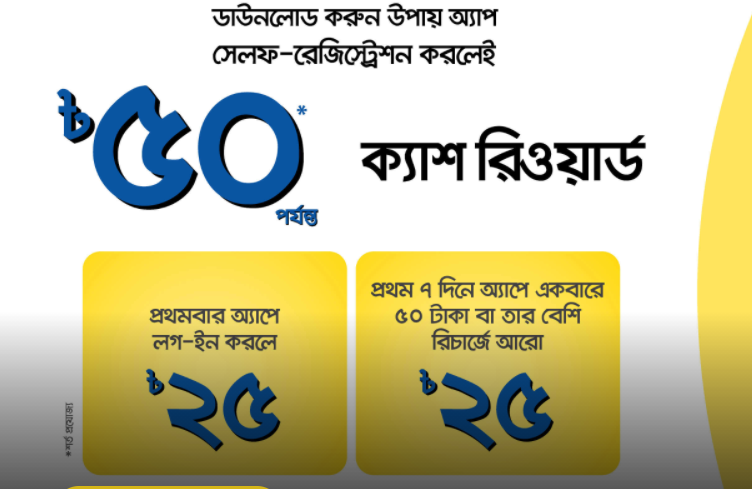

How to get 50 TK Bonus?

Just Install the App and then Register. You need to have National ID Card and Active Mobile Phone to get the Reward. After Successful Registration, you will get 25 TK Instant Bonus. After Recharging 50 TK or more from the App, you will get another 25 TK as Bonus Instantly.

Benefits of Upay Mobile Banking

The Upay is a mobile app, you can use it if you have an account through Upay, you can use it even if you don’t have it. ‘Upay’ apps can be downloaded and used, but the identity card must match the NID card. After downloading the ‘Upay’ apps, you have to give the front and back picture of your NID card in some options. ‘Upay’ apps can be used when the account is fully created with all the information correctly. The facility of ‘Upaya’ apps is that you will get various value-added services including payment, mobile recharge, money transaction on mobile, utility bill payment, payment of purchase price, acceptance of remittance, payment of salary, airtime purchase, Indian visa fee, traffic fine payment.

You can cash out without a debit card and credit card and with an ATM card. You can withdraw up to a maximum of BDT 25,000. Payment service money can be transferred with ‘Upay’ apps. 15 thousand to 30 thousand or three lakh TK can be withdrawn every month through ‘Upaya’ apps. Upay’s agents across the country will be able to take customer service from the commerce network.

Upay Registration Bonus

- Download the “UPay” app from the play store, complete self-registration, and log in to get 25 taka “Cash Reward” instantly.

- Get another 25 taka “Cash Reward” on a single mobile recharge transaction of BDT 50 or above from the customer app within 7 days of the 1st App Login.

At present, about 80% of the mobile transactions of the people of Bangladesh are done through USSD. Most of the people of Bangladesh are mainly disadvantaged, poor, and low-income people. Therefore, considering the people of the country, UCB Fintech Company has a fixed cash-out charge at the lowest rate in the market for those who transact through USSD. So, the customers of ‘Upaya’ can cash out using UCBL’s ATM card for only Tk 8 per thousand. But users of ‘Upaya’ apps can also cash out by spending 14 rupees per thousand. Upaya’s customers can transfer any amount of money from one account to another without any charge in accordance with the rules of Bangladesh Bank.

UCB Upay Customer Service

- Email: info@upaybd.com

- Call: 16268

- Website: www.upaybd.com

- Head Office: Plot CWS (A) -1, Road 34, Gulshan Avenue, Dhaka – 1212, Bangladesh

Moreover, UCB’s ‘Ucash’ band has been providing mobile banking services for eight long years. But with the launch of mobile banking ‘Upaya’ apps, UCB’s ‘Ucash’ band was shut down. So all the customers of ‘Ucash’ are now able to enjoy all kinds of opportunities of mobile banking services as the customers of ‘Upay’. At present, 15 banks in Bangladesh are providing this service.

Saidul Haque, Managing Director, UCB Fintech, said, “Upay to be a dream partner in building a ‘Digital Bangladesh’ by accelerating financial inclusion by providing continuous digital financial services to millions of people in the country.

A new chapter in digital financial services is currently being launched through ‘Upay’.

UCB Fintech’s Managing Director said that ‘Upay’ will alUpay be by their side with excellent customer service, secure transactions, and constant innovation by giving utmost importance to customer’s needs.